Mastercard Agent Pay is a groundbreaking payment innovation designed for the age of AI agents and autonomous commerce. Launched in 2025, it allows trusted AI systems to securely complete transactions on behalf of individuals and businesses, without the need for human involvement at every step.

As artificial intelligence becomes central to how people discover, compare, and buy products online, Mastercard is stepping in to ensure that payments in these AI-led workflows are secure, authorized, and seamless. This blog explores what Agent Pay is, how it works, why it matters, and how it compares to similar platforms.

Understanding Mastercard Agent Pay

At its core, Mastercard Agent Pay is a payment infrastructure designed for interactions between businesses and AI agents, software systems that act on a user’s behalf.

Traditionally, a human user clicks a button to check out. In the world of agentic commerce, an AI assistant might research a product, compare alternatives, select the best option, and complete the purchase—all by itself. Mastercard Agent Pay is the system that ensures such autonomous transactions are secure, authenticated, and authorized.

How Mastercard Agent Pay Works

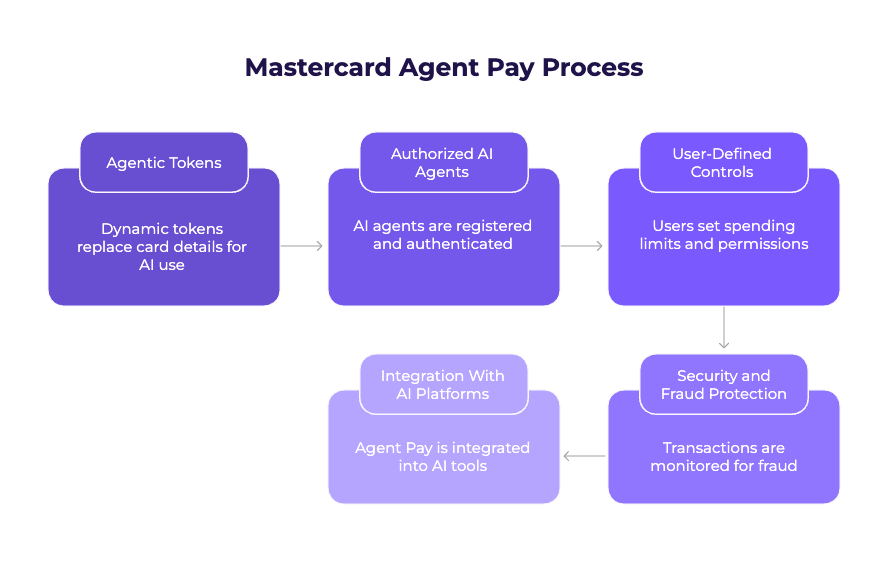

Mastercard Agent Pay is built on five key pillars:

1. Agentic Tokens

These are dynamic, secure tokens that replace sensitive card details. Just like the tokenization used in mobile wallets or online subscriptions, these tokens are tailored for AI use. Each AI agent gets a unique token with pre-set limits and permissions.

2. Authorized AI Agents

Before an AI assistant can make a purchase, it must be registered and authenticated. This ensures that only verified and trusted agents are allowed to access payment credentials.

3. User-Defined Controls

Users can define how much spending authority an agent has, what categories of purchases are allowed, and when human confirmation is needed. These controls ensure that AI agents remain within safe boundaries.

4. Security and Fraud Protection

All transactions go through Mastercard’s fraud detection engine and tokenization framework. Biometric authentication and real-time alerts ensure users are in control of agent-based payments.

5. Integration With AI Platforms

Mastercard has partnered with major AI providers and payment processors to integrate Agent Pay into both consumer-facing and enterprise AI tools. This allows for end-to-end transactions directly within AI interfaces.

Why Mastercard Agent Pay Matters

As AI tools like ChatGPT, Copilot, and other autonomous agents become part of everyday commerce, businesses need a way to enable agent-led purchases without compromising on security.

Here’s why Mastercard Agent Pay is a game changer:

- Frictionless shopping experience: AI agents can now complete entire buying journeys, from research to payment, within one interface.

- Consumer trust: Secure tokens and clear user permissions ensure that users are never out of control.

- Enterprise automation: Businesses can delegate routine purchases to internal AI systems using virtual corporate cards, improving efficiency and speed.

- Foundation for future commerce: Agent Pay sets a precedent for how brands and platforms will interact with AI-driven buyers.

Real-World Use Cases

- AI Travel Assistants: Booking flights, hotels, and car rentals based on user preferences, and making payments directly via Agent Pay.

- B2B Procurement Agents: AI systems sourcing inventory, negotiating contracts, and paying suppliers using secure virtual tokens.

- Virtual Personal Shoppers: Recommending and purchasing products autonomously after a user defines style or budget preferences.

- AI-Powered Subscriptions: Managing recurring payments for cloud services, SaaS tools, or media platforms without manual intervention.

Similar Platforms to Mastercard Agent Pay

While Mastercard is pioneering this space, other companies are also exploring agentic commerce infrastructure:

Visa Payment Passkeys

Visa has been investing in passkey-based authentication and card-on-file systems for AI transactions. However, Visa’s offering is still largely user-initiated rather than agent-led.

Stripe Autonomous Commerce

Stripe is experimenting with AI integrations where bots can trigger payments for e-commerce, but they rely heavily on human confirmations today.

OpenAI’s Agent API + Payments

OpenAI has introduced APIs for autonomous agents and may allow plug-ins that connect to commerce and payment platforms. However, they currently rely on third-party integrations for payments.

Amazon Pay for Alexa

Alexa’s voice assistant has allowed transactions for years, but those are typically limited to Amazon’s ecosystem and require spoken confirmation.

While these platforms are working toward enabling AI-led commerce, Mastercard Agent Pay is the first to launch a dedicated, standardized payment rail designed specifically for AI agents.

Final Thoughts: The Future of Agentic Payments

Mastercard Agent Pay is not just another payment feature. It’s a foundational layer for a future where AI systems become active participants in commerce. As buyers increasingly rely on AI to make decisions and purchases, businesses must adapt to this new mode of interaction.

Brands that want to thrive in the age of agentic commerce must be ready to:

- Recognize when AI agents, not humans, are visiting their sites

- Provide relevant content and accurate data for agents to evaluate

- Enable seamless, secure transactions when the agent decides to buy

Agent Pay makes the last step possible, secure payments in the age of autonomous commerce. It’s not just about helping people buy faster. It’s about helping machines buy responsibly.